本文原文发表于《经济学人》2017年10月26号刊特别报道。原文地址是:https://www.economist.com/special-report/2017/10/26/stores-are-being-hit-by-online-retailing。本文仅作翻译习作,所有版权归原作者。如需转载,请联系站长。

Shop till you drop

买到手软

Stores are being hit by online retailing网络购物冲击实体店

The painful metamorphoses of physical shops

实体店转型的阵痛

Oct 26th 2017

2017年10月26日

WHEN AMERICA’S RETAIL bosses gathered in New York earlier this year for the annual shindig of their trade association, the National Retail Federation, there was much talk about new technology to improve the industry’s prospects, from sensors that read consumers’ facial expressions to machine-learning software that can optimise prices.

今年,全美零售商联盟在纽约召开零售业年会盛宴,美国各大零售领袖齐聚一堂,商讨如何借力新科技改善零售业,比如用感应器读取消费者面部表情、用自主学习软件优化定价策略。

The ghost at the banquet was the company that gave no presentations but made its presence felt everywhere:

晚餐上有一家公司,虽然没有上台,却引得在座所有人侧目,那就是:

Amazon.

亚马逊。

Traditional retailing has had a tough time lately.

最近,传统零售业步履维艰。

Traffic in shopping centres in Europe’s biggest markets has been declining.

在欧洲,即使是最大的商场和购物中心,人声也已不再鼎沸。

In America, which has about five times as much space in shopping centres per person as Britain, the pain is acute.

在美国,购物中心更宽敞,人均购物空间是英国的五倍,这种衰败的痛因此更加切肤。

Chains that were faltering even before Amazon’s ascent are now in even deeper trouble.

亚马逊壮大之前,一些连锁品牌就已经初现颓势,现在处境更是深陷泥沼。

Macy’s, a department store, last year said it would close 100 of its 728 shops.

去年,梅西百货透露,将在728家分店中关闭100家。

Fung Global Retail & Technology, a consultancy, expects nearly 10,000 stores in America to close this year, about 50% more than at the height of the financial crisis in 2008.

冯氏全球零售科技咨询公司预计,今年近万家美国商店将关门停业,比2008年全球金融危机最恶劣的时候还多一半。

And there will be more to come.

而且倒闭的商店越来越多。

Shops used to compete by offering a combination of selection, price, service and convenience.

商店的竞争力,取决于商品种类、价格、服务、便利性。

E-commerce’s most obvious edge is in selection and convenience.

而电子商务最明显的优势在于品类丰富、购物方便。

Even the biggest store cannot hold as many items as Amazon can offer.

就算商店再大,卖的商品也不可能比亚马逊多。

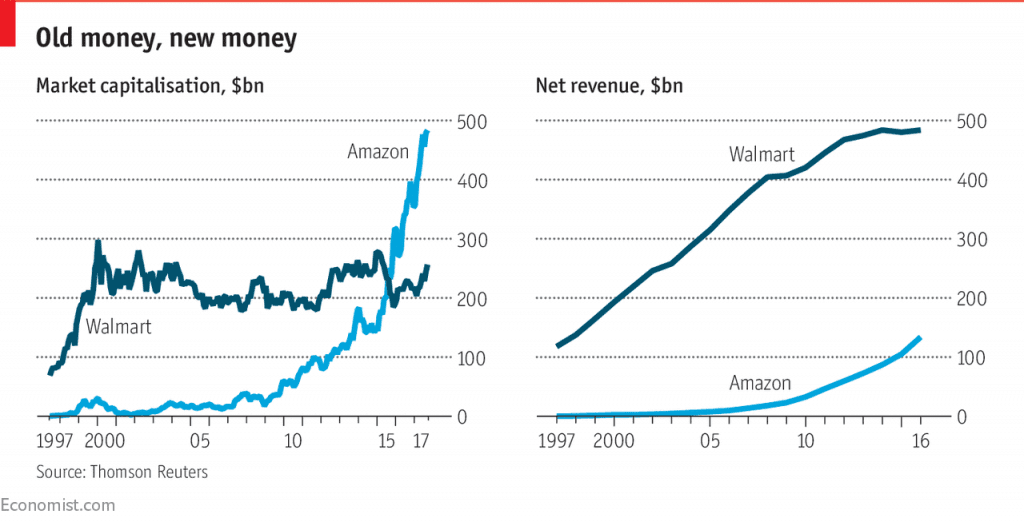

Walmart conquered America by saving consumers money; Amazon is doing the same by saving them time.

沃尔玛之所以深得民心,是因为价廉实惠;亚马逊之所以深得民心,是因为快捷省时。

Shops still provide immediacy and a personal experience.

实体店的优势在于消费者能亲身体验购物过程。

But though getting attentive service at Gucci may be fun, waiting to pay at the supermarket is not.

但是,就算古驰店员的服务很贴心,等排队买单时也会很闹心。

E-commerce firms are also competing on new kinds of service and pricing.

电子商务公司还彼此竞争,推新服务,压低价格。

A website knows more about you than any shop assistant can, enabling it to offer personalised recommendations straight away.

购物网站对你了若指掌,哪个商店售货员都比不上,因此能最迅速推荐最适合你的产品。

Online, a shopper can easily compare prices between retailers.

在网上购物,消费者货比三家不费吹灰之力。

More intriguingly, merchants can quickly move prices up or down, using bots to match competitors’ offerings.

还有更厉害的,网商可以利用程序自动跟着竞争者报价迅速抬价降价。

Eventually this pricing may become more personalised.

最后,消费者看到的价格可能是针对他一个人定制的。

Alibaba and JD already use their troves of data to offer discounts on particular products to some of their customers.

阿里巴巴和京东早就挖掘自己的海量数据,给特定的顾客提供特定产品的折扣。

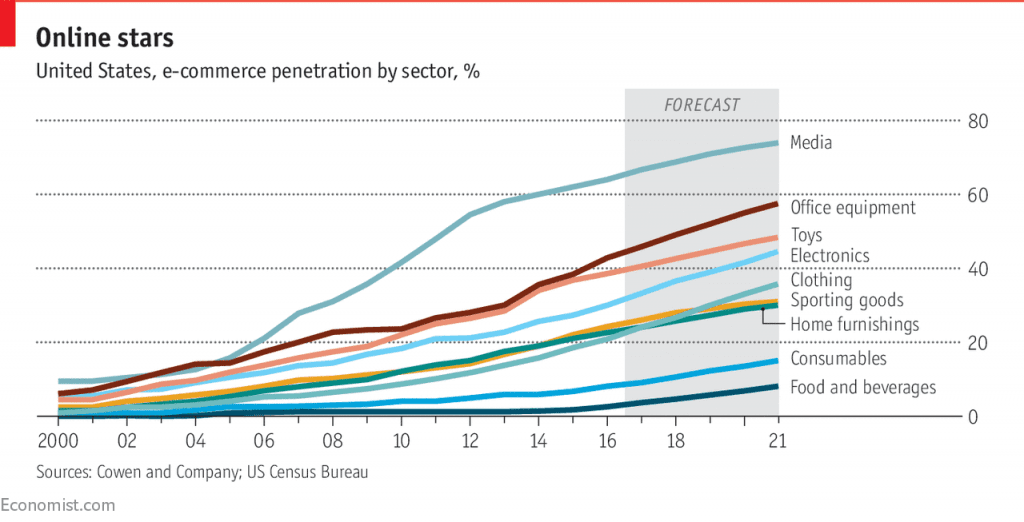

All this has meant that consumers are now buying a wider range of goods online.

这说明,消费者在网上消费的品类越来越广。

The shift has been most dramatic in America, home to both a relentlessly disruptive e-commerce giant and a herd of entrenched retailers (which China lacks).

这种变化在美国最明显,毕竟美国有电商怪兽亚马逊,以及一群根深蒂固的零售商(这点和中国不同)。

Consumers still buy certain types of goods in stores, such as food and building equipment.

有些商品,消费者还是去实体店买,比如食物和建筑设备。

But many shops have had no choice but to follow consumers online, setting up their own e-commerce businesses as they maintain their bricks-and-mortar ones.

但是很多实体店束手无策,只能跟着消费者移步网络,开始自己的电商业务,线上线下都经营。

In the short term, this only exacerbates their problems.

短期内,这么做只会加剧问题。

Building an e-commerce business on top of a traditional one is costly; firms must create websites and ship products to individual consumers, rather than to stores in bulk.

在传统业务之上叠加电商业务需要付出很大成本,这些公司得建网站,把商品运送给每个客户,而不是批发给商店。

It does not help that Amazon has conditioned consumers to think delivery should be free.

更何况,亚马逊已经让消费者习惯了免费配送。

Moreover, online sales often cannibalise those from existing shops.

再者,网上销售额一般会抢走线下的销售额。

Analysts at Morgan Stanley reckon that for each additional percentage point of shopping that moves online, a retailer’s margins shrink by about half a point.

摩根士丹利分析称,对于零售商来说,转到线上的消费额每增加1%,其利润就会降低0.5%。

Bricks-and-mortar shops also often have trouble recruiting technology staff.

实体店也很难招聘技术人员。

For a hotshot data scientist, working at a department store is not an obvious choice.

数据分析高手一般也不会去百货商店屈才。

Traditional chains must routinely pay a premium to lure skilled tech workers.

传统的连锁商店必须花高价才能吸引优秀的技术人员。

Amazon has no such difficulty.

可是亚马逊根本没这些困难。

Startups, tech firms and consultants are offering tools to help smaller retailers adjust.

现在,新公司、技术公司、技术顾问开发了一些工具,帮助小零售商适应新市场。

Some of the more interesting ones promise to narrow the gap between what e-commerce sites and physical stores know about their customers.

有些公司志在帮助实体店进一步了解顾客,缩小与电商网站在这方面的差距。

Floor mats can measure store traffic, video analytics will track shoppers’ age, sex and mood, and beacons can gather data about what customers do in the shop once they have signed up for free Wi-Fi.

用地毯记录店内客流量,用摄像头记录消费者的年龄、性别、心情,向消费者提供免费WiFi,用网络热点记录消费者在店内都干了什么。

For now, though, many American firms are reluctant to invest in such expensive new technology for shops that may not be there for much longer.

目前,在美国,很多公司都舍不得给自己的商店投资这些昂贵的新科技,反正这些商店也维持不了多久。

In China, those offering to remedy retailers’ woes include some of the big e-commerce firms, and retailers may be happy to work with them because their platforms are so pervasive.

在中国,很多电商大公司都主动帮助零售商,零售商业同样乐意合作,因为这些电商平台深入百姓生活。

In the West, small merchants already pay Amazon to list products on its site and store goods in its warehouses.

在西方各国,小商家早就付钱给亚马逊,在亚马逊网页上展示商品,用亚马逊的仓储。

The small sellers can reach more consumers more easily; Amazon earns fees and, thanks to sellers’ listings, can offer a broader selection.

这样,小商家更容易接触更多的消费者。而亚马逊既能挣到钱,也能提供更多商品共消费者选择。

Big retailers, on the other hand, seem much less likely to team up with Amazon.

反观大零销商,似乎不太愿意和亚马逊合作。

Target and Toys“R”Us chose Amazon to handle their e-commerce businesses in the early 2000s, but both ended the partnership, with Toys”R”Us doing so in court.

早在新千年初,塔吉特(Target)和玩具反斗城就和亚马逊合作,通过亚马逊进行网上销售,但是后来都终止了这种合作,玩具反斗城还因此把亚马逊告上公堂。

Unlike Alibaba, Amazon owns much of the stuff it sells, so competes directly with any seller that uses its services.

与阿里巴巴不同,亚马逊上卖的很多是自营商品,所以跟第三方卖家形成直接竞争。

Despite such troubles, there are examples of how bricks-and-mortar shops might thrive.

虽然处境艰难,但是有几家实体店还是生机勃勃。

One strategy is to offer distinctive products that are not available elsewhere (as does Zara, a clothing chain owned by Inditex), or which are difficult to sell online.

一种是保证自己的产品别的地方买不到(比如盈迪德集团旗下的Zara),或者很难拿到网上卖。

A second is to give shoppers a great deal.

二是给消费者很大的实惠。

TJX, an American firm, offers manufacturers’ surplus goods at bargain prices.

美国公司TJX就是将生产商剩余货品用超低价出售。

Another option is a great experience: champagne at Louis Vuitton, perhaps, or personalised advice at Nike.

还有一种办法也很值得借鉴,即提供卓越的购物体验:比如路易威登(LV)店里提供香槟酒,耐克店里提供私人顾问。

The most difficult route is to try to match Amazon’s retail standards and offer more.

和亚马逊正面交锋,还想比它做的更好,是最辛苦也是最困难的一条路。

Walmart, once the undisputed king of American retailing, is mounting the boldest counteroffensive.

沃尔玛,这个当年在美国零售市场叱咤的霸主,采取的就是最强硬的反击。

It can no longer simply open stores to boost growth; 90% of Americans already live within ten miles of a Walmart.

光靠开新店已经没办法刺激增长了,沃尔玛超市16公里的辐射范围已经覆盖了90%美国人口。

So the company is seeking to protect its margins by making stores even more efficient—saving $7m by printing shorter receipts, for instance—while investing online.

所以沃尔玛希望提高商店的效能,保持自己的霸主地位——比如缩短收据长度就能节省700万美元——还有投资网店。

Last year it spent $3.3bn buying Jet.com, an e-commerce site founded by Marc Lore, who now oversees Walmart’s suite of online businesses.

去年,沃尔玛投资33亿美元收购了马克·洛尔创办的电商网站jet.com,并把自己的所有在线业务交给马克主持。

He is not trying to match Amazon’s breadth.

他就没打算和亚马逊比货品种类多少。

“We are focused on being a retailer,” he declares.

“我们想专心做好零售。”他说。

But Walmart is trying to catch up with Amazon in other ways.

但是沃尔玛希望在别的方面追赶亚马逊。

The company now offers free two-day shipping.

比如沃尔玛现在提供免费送货,隔日送到。

Just as JD’s integration with Tencent is helping it challenge Alibaba, Walmart may succeed by partnering with tech giants.

沃尔玛如果想成功,可以与科技巨头达成合作,就像京东与腾讯的联姻,就足以挑战阿里巴巴。

In August it said it would sell through Google’s voice assistant, in a bid to counter Amazon’s Alexa.

八月时,沃尔玛宣布接入谷歌语音助理销售,以抗衡亚马逊的Alexa语音助理。

Walmart can also use its vast network of stores to do things Amazon cannot.

沃尔玛还可以利用自己庞大的店铺网络为亚马逊之不可为。

In one experiment, Walmart staff drop off customers’ orders on their way home.

比如,他们曾经试验让员工下班回家路上给顾客派件。

And as America’s biggest grocer, it has developed an easy way for customers to order food online, then drive to a Walmart where staff load it into their car.

身为美国最大的食品杂货店,沃尔玛有很成熟的系统,方便顾客网上下订单买食物,然后开车去附近的店面,由服务员将订单装车。

Even as Walmart adapts, however, Amazon continues to morph.

但是,沃尔玛求变的时候,亚马逊也没有默守陈规。

It is using machine learning to measure the ripeness of a peach and to determine how many blue shirts to stock in which size.

现在可以用机器学习鉴别桃子成熟程度,还能分析该进货多少件各类尺寸的蓝色衬衫。

Constant innovation gives it a huge competitive advantage which many retailers will struggle to match.

亚马逊通过不断创新,使其领先优势明显,其他零售商只能望其项背。

Too many physical stores lack the strategy or distinctive merchandise that might help them thrive in retail’s new era.

有太多实体商店缺少策略或者缺少独特的商品,因此很难在零售新时代立足。

And in the main they still rely on the customers coming to them to choose their purchases, whereas their rivals deliver.

他们还是靠消费者主动上门消费,而电商已经主动出击送货上门了。